Cash Flow Hedge Vs Fair Value Hedge

Morningstars Dan Wasiolek has a 15 fair value target for Sabre stock which is more than double the closing price of 634 on July 11. If transaction has not been designated as fair value hedge.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

In accounting and in most schools of economic thought fair value is a rational and unbiased estimate of the potential market price of a good service or asset.

. It is defined as money in the form of currency coins and notes. UPDATE 1-UK hedge fund founder charged in New. The value of tangible assets adds to the current market value but the value gets added to the potential revenue and worth in the case of intangible assets.

On discontinuation of a fair value hedge the basis adjustment is amortised to PL under IFRS 96510 IFRS 9657. International Financial Reporting Standards - IFRS. Hedge fund salaries vary a lot based on the fund size type strategy annual performance and other factors.

Discontinuation of fair value hedge. Discontinuation of cash flow hedge. Focusing on the first two hedging arrangements our comprehensive guide to cash flow hedge vs.

When hedge accounting for cash flow hedge is discontinued the accounting depends on whether the hedged cash flows are expected to occur. Present Value of 10-year Cash Flow PVCF. Fair value hedge provides you with all the information you need about the benefits and limitations of these useful financial instruments.

Compared to the current share price of US276 the company appears around fair value at the time of writing. More specifically a speculative hedge fund with an expertise in forecasting future. ATUS Altice is a midsize cable TV operator.

The derivation takes into account such objective factors as the costs associated with production or replacement market conditions and matters of supply and demandSubjective factors may also be considered such. Conversely private equity funds tend to. Cash accounts and margin accounts.

For fair value hedge we consider hedging gain or loss arising from hedging instruments in profit or loss statement. Cash stored in the bank account is the best example for this discussion because it is one of the most liquid assets for the company and can be a lot of help for the company to repay back its short-term obligations. Tangible vs Intangible Comparison Table Lets look at the top 8 Comparisons between Tangible vs Intangible.

A demand deposit plays a rile here which is defined as a kind of account from where fund can be. Effectively this bank will have guaranteed that its revenue will be greater than it expenses and therefore will not find itself in a cash flow crunch. But there are numerous differences between stocks and cryptocurrencies.

At the inception you need to perform the prospective hedge effectiveness assessment. Hedge Fund Analyst Salary and Bonus Levels. Online brokers offer two types of accounts.

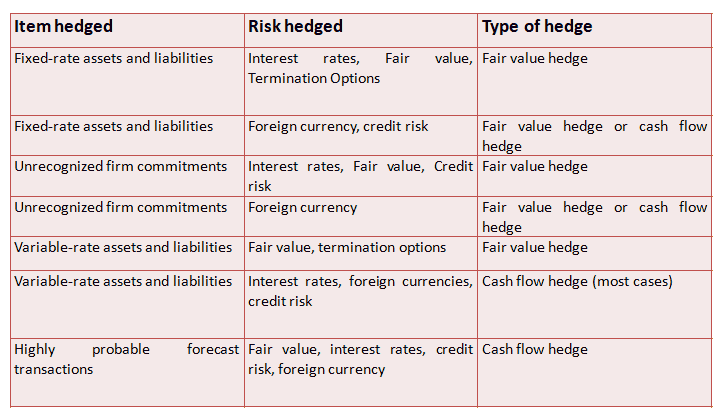

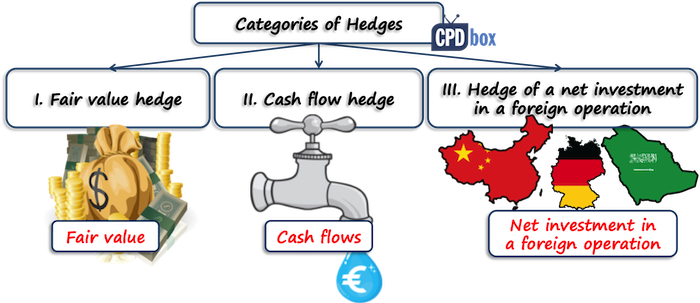

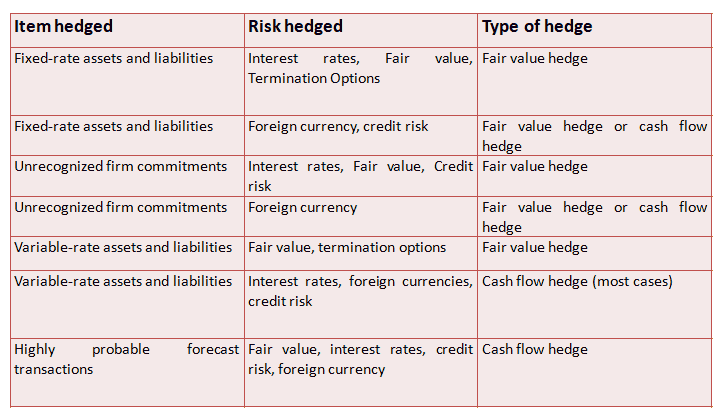

Cash flow hedges which hedge the exposure to variability in expected future cash flows of recognized assets liabilities or any unrecognized forecasted transactions. Cash flow hedge fair value hedge and net investment hedge. While hedge funds invest in anything and everything most of these positions are highly liquid meaning the positions can be readily sold to generate cash.

Hedge funds which rely on speculation and can cut some risk without losing too much potential reward. This is a typical hedge of the forecast transaction it is a cash flow hedge. International Financial Reporting Standards IFRS are a set of international accounting standards stating how particular types of transactions.

Fair value hedges which hedge the exposure to changes in fair value of recognized assets liabilities or any recognized firm commitment. Cryptocurrencys rapid appreciation has many investors questioning the place of stocks in their portfolios. ZeroHedge - On a long enough timeline the survival rate for everyone drops to zero.

The most likely range for total compensation at the Analyst level is 200K to 600K USD. There are three recognised types of hedges. The company appears about fair value at a 18 discount to where the stock price trades currently.

Both allow you to buy and sell investments but margin accounts also lend you money for investing and come with. Yes I am intentionally using a wide range because of all those factors above. Present Value of 10-year Cash Flow PVCF US420m.

Difference Between Fair Value Hedge And Cash Flow Hedge Cpdbox Making Ifrs Easy

Ifrs 9 Practical Hedge Documentation Template Annual Reporting

How To Determine Fair Value Hedge Or Cash Flow Hedge Under Ind As 109

Cash Flow Hedge Vs Fair Value Hedge Ppt Powerpoint Presentation Pictures Guidelines Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

No comments for "Cash Flow Hedge Vs Fair Value Hedge"

Post a Comment